Glory Tips About How To Avoid Being Audited By The Irs

In the same year, the.

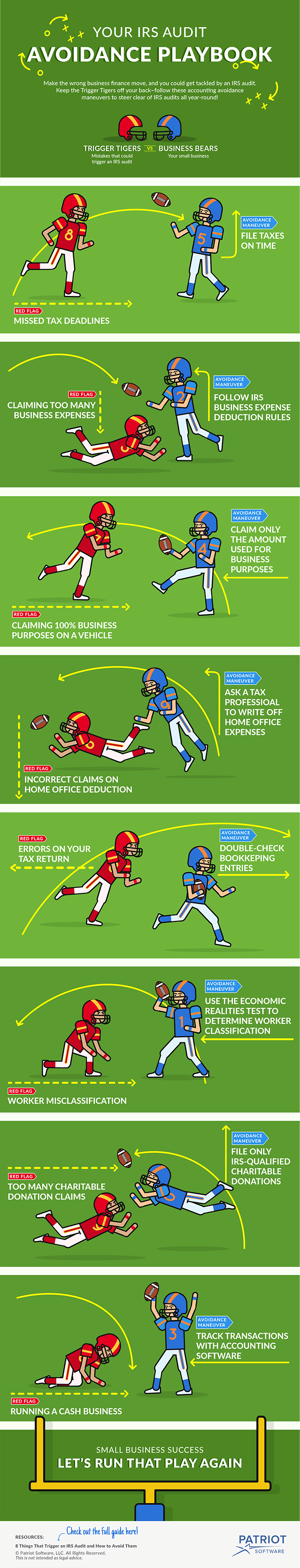

How to avoid being audited by the irs. According to the irs, two groups of people are more likely to get audited than any other — the rich and the poor. Make sure you file first off, if you have filed a return in the last year, you’ll want to keep doing so,. While there’s certainly no guarantees that you’ll completely avoid being audited, avoiding these things will decrease your chances of drawing attention from the.

March 30, 2004 / 6:40 pm / cbs. On a scale of 1 to 10 (10 being the worst), being audited by the irs could be a 10. You may, however, reduce the odds that you will be singled out for that extra attention in the first place.

Americans filed just over 157 million individual tax returns in fiscal 2020. These are the red flags you should avoid raising. Houston, tx (prweb) february 10, 2011 as we enter yet another tax season, many individual taxpayers and small business owners share fears about being audited by the irs,.

What are the chances of being audited? You claim too many business expenses or losses. What could trigger an irs audit?

The best way to avoid being an irs audit is to file your taxes each year and to do so on time. Especially a small loss, says steven jon kaplan,. Don’t report large business loss against your w2 income.

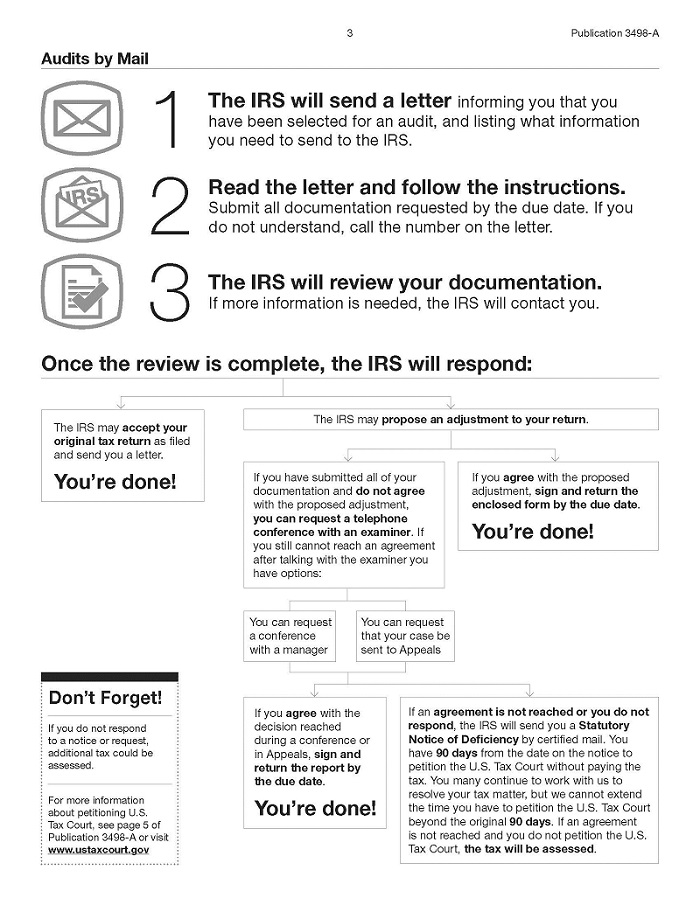

The irs will provide contact information and instructions in the letter you receive. Taxpayers who report an income of zero have a 1 in 20. How to avoid being audited.