Beautiful Work Info About How To Avoid Uk Capital Gains Tax

1 use your cgt exemption.

How to avoid uk capital gains tax. You might be able to minimise your cgt liability by using losses to reduce your gain. That means you’ll need to pay £31,986 if you’re in a lower tax bracket and 49,756 if you’re in a higher tax bracket. First, understand the rules and be sure that everything is correct before selling your home.

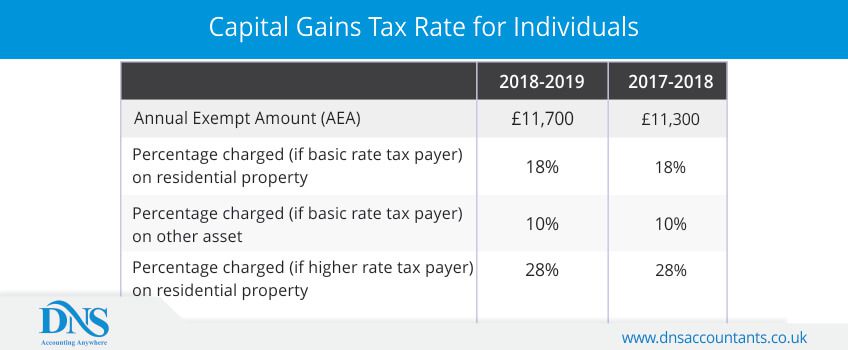

How can i avoid capital gains tax when selling a second. At the time of writing, the current amount for. Here are some ways to potentially reduce your capital gains tax liability.

How can i reduce capital gains tax on a property? If you want to make a profit from the sale of your house, you will owe capital gains taxes. On the other hand, say you made a $280,000 profit off the sale.

How do i avoid capital gains tax on a second home uk? You can do a few things to avoid capital gains tax on your second home. In addition to your primary income, you’ll also want to calculate how much you’ve earned from other sources, such as your pension.

(which, since all of that would. If you sell a property that you have lived in as your 'only or main residence', the gain can be exempt from cgt, in whole or in part. This is because the sale is considered income;

Here are three methods for avoiding capital gains tax on shares: Everyone has an annual cgt allowance, which is currently £12,300 for the 2022/23. 2 make use of losses.