Smart Info About How To Become A Loan Officer In Illinois

Offer more loan options and lower rates as an independent mortgage broker

How to become a loan officer in illinois. A degree is not required to become a loan officer but is helpful. To do business as a mortgage loan originator, you need to: Some banks and mortgage companies require loan officers to hold a bachelor’s degree, so it can about four years to qualify for these jobs.

Above total does not include sales tax. You earn your mortgage license in illinois by: To become a mortgage loan originator (mlo) in illinois, first go to the nmls website to register for your “unique identifier.” you will get an nmls (nationwide multistate licensing system).

Request an nmls account before beginning the educational component of licensing, prospective loan officers must. How to get a mortgage loan officer license in illinois. The mortgage loan originator license is required for an individual who, for compensation or gain or in the expectation of compensation or gain, takes a residential mortgage loan application, or.

Get your loan officer license for illinois with mortgage educators as a result of the secure and fair enforcement for mortgage licensing act (safe act) of 2008, mortgage loan originators. How to get your license. Apply for an nmls account and id number.

To become a mortgage loan officer, you need to be at least 18 years old and have a high school diploma or ged. How long does it take to become a loan officer? Offer more loan options and lower rates as an independent mortgage broker

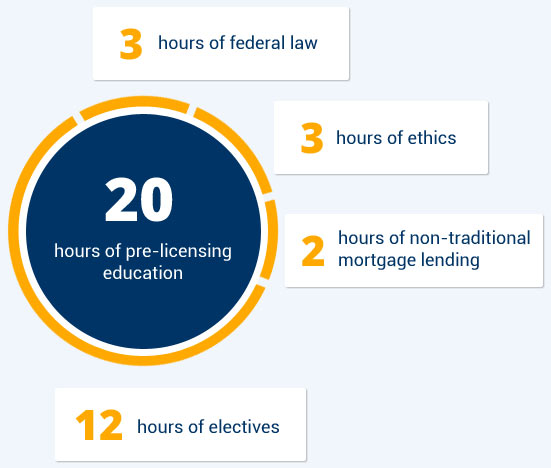

Below shows a breakdown of hours needed for each section: A college degree in finance, economics, or a field related to banking can give you the background knowledge desirable in a loan officer. How to get a mortgage loan officer license in illinois 1.

:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)